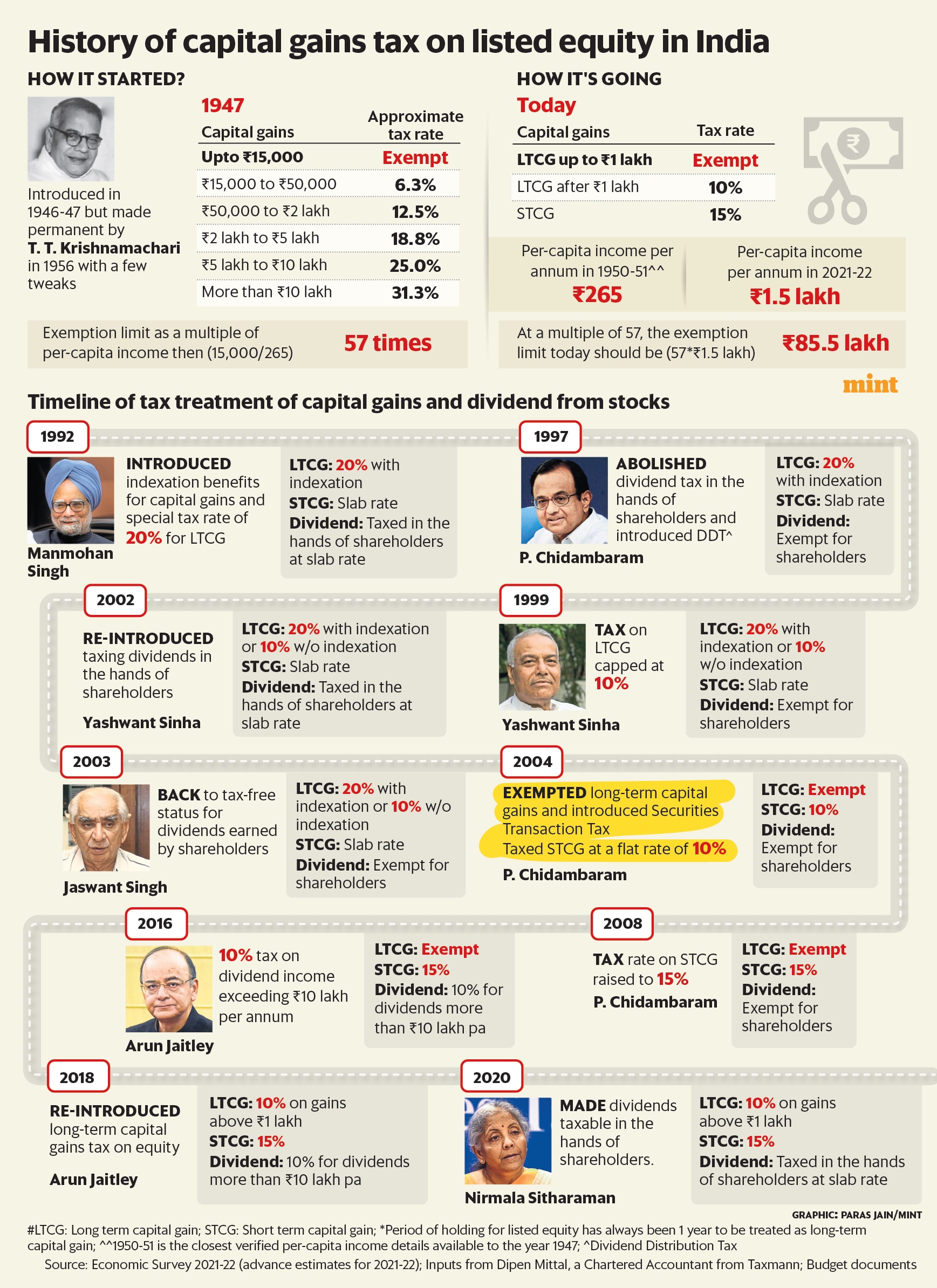

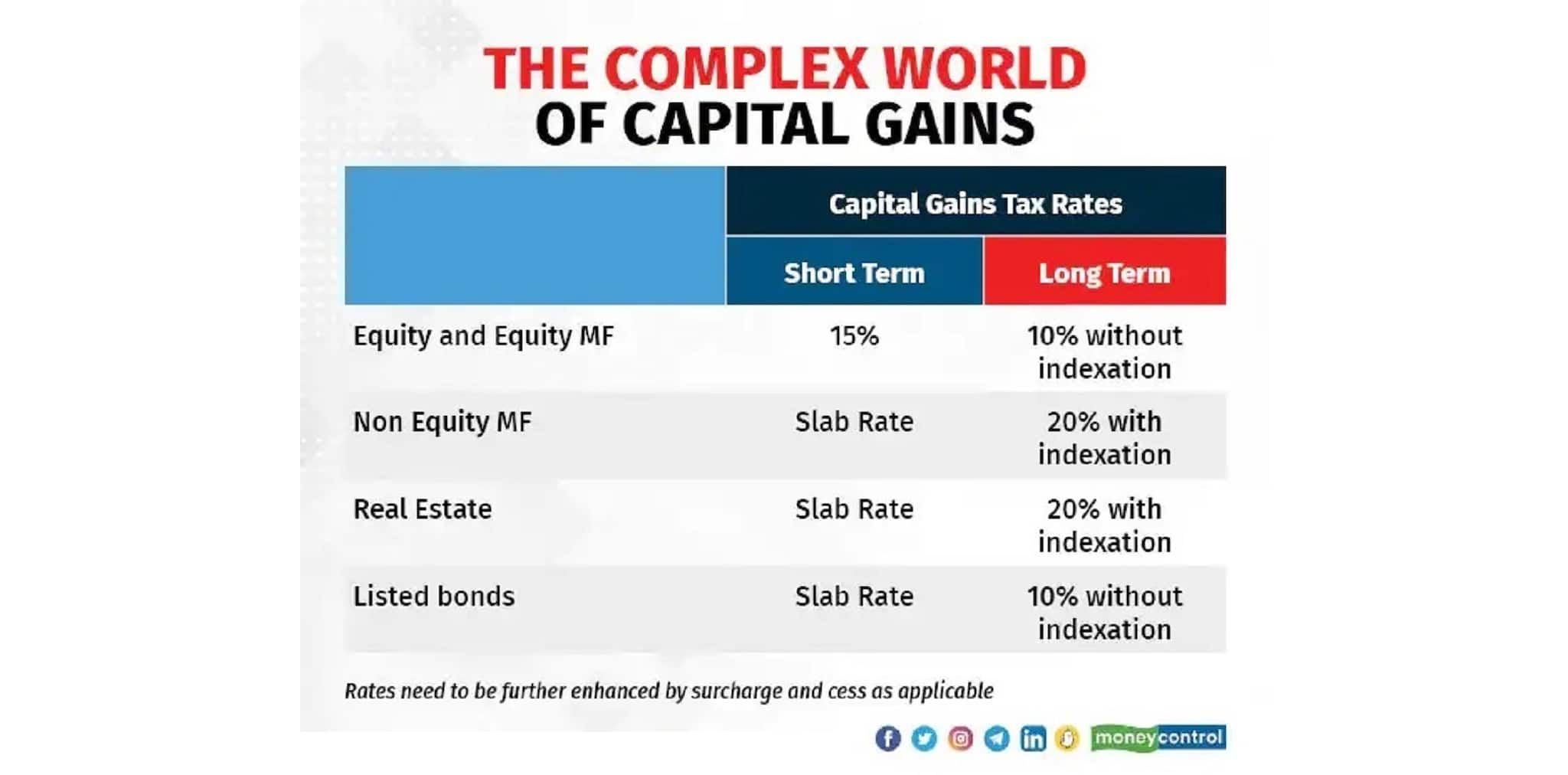

Budget 2023 Expectations: Shorter holding period for non-equity funds, hike in equity LTCG limit to Rs 2 lakh

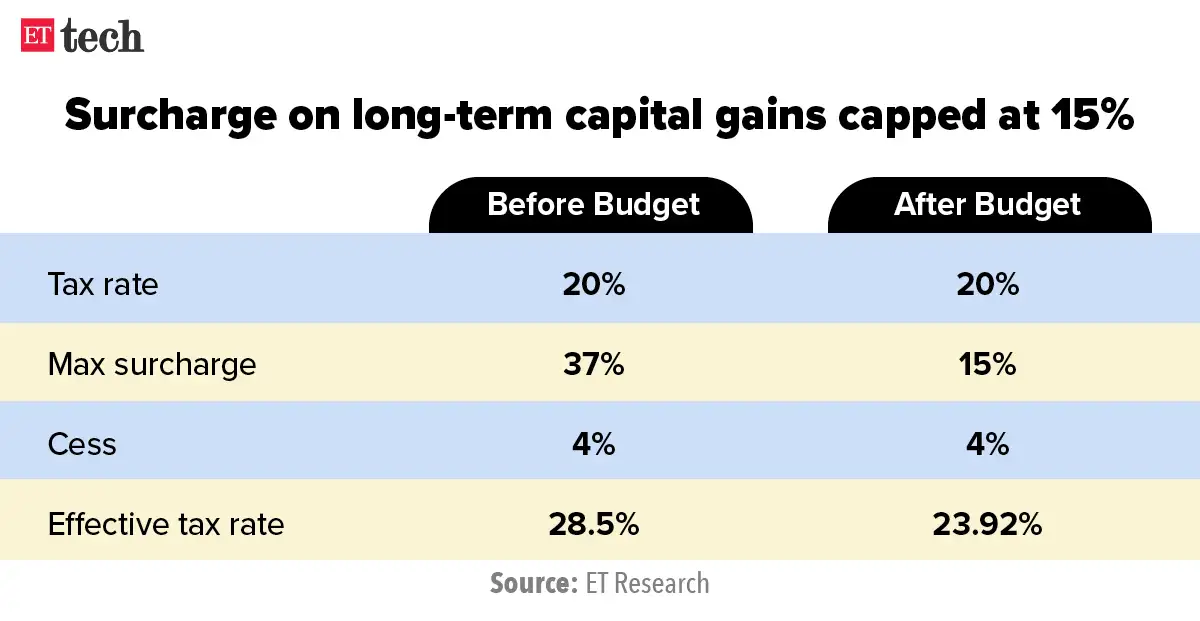

budget 2022: Budget 2022: Startup founders, investors to benefit from 15% cap on tax surcharge - The Economic Times

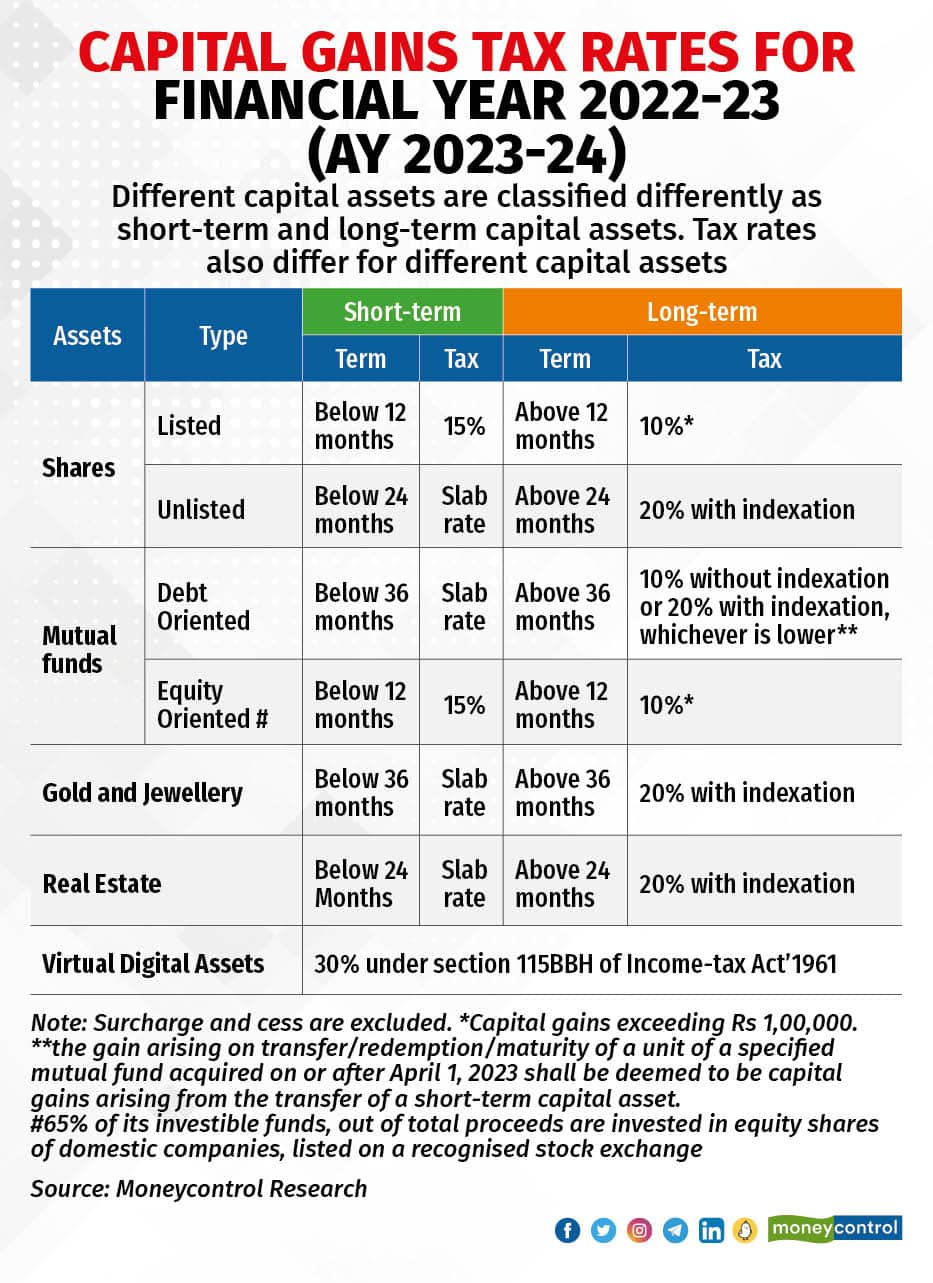

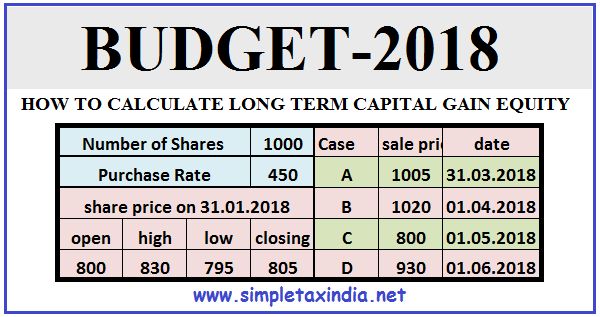

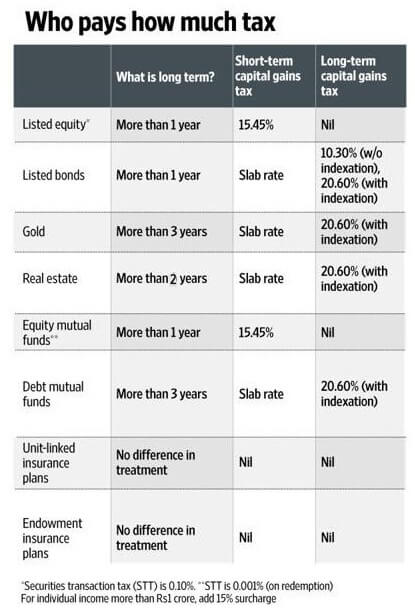

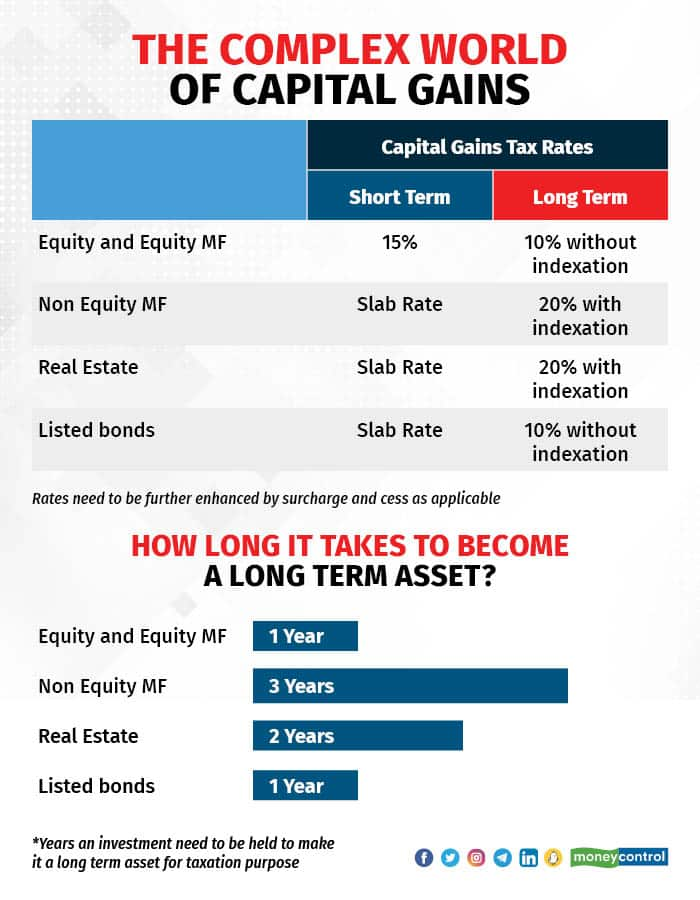

Rationalisation of holding period requirement Most investors find it hard to get a clear idea of threshold limits for deciding if an asset is classified as long-term or short-term to decide the