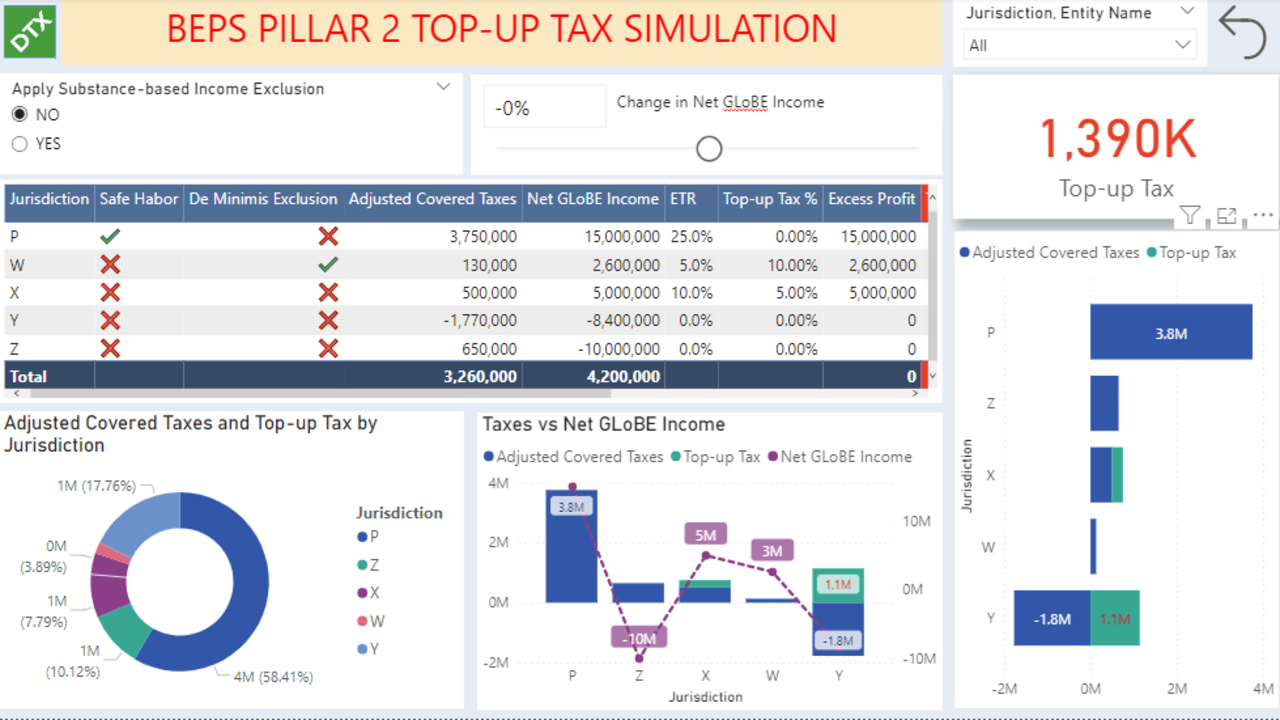

3. Tax revenue effects of Pillar Two | Tax Challenges Arising from Digitalisation – Economic Impact Assessment : Inclusive Framework on BEPS | OECD iLibrary

Global Minimum Tax (GMT) (OECD Pillar 2): the decisive moment | Inter-American Center of Tax Administrations

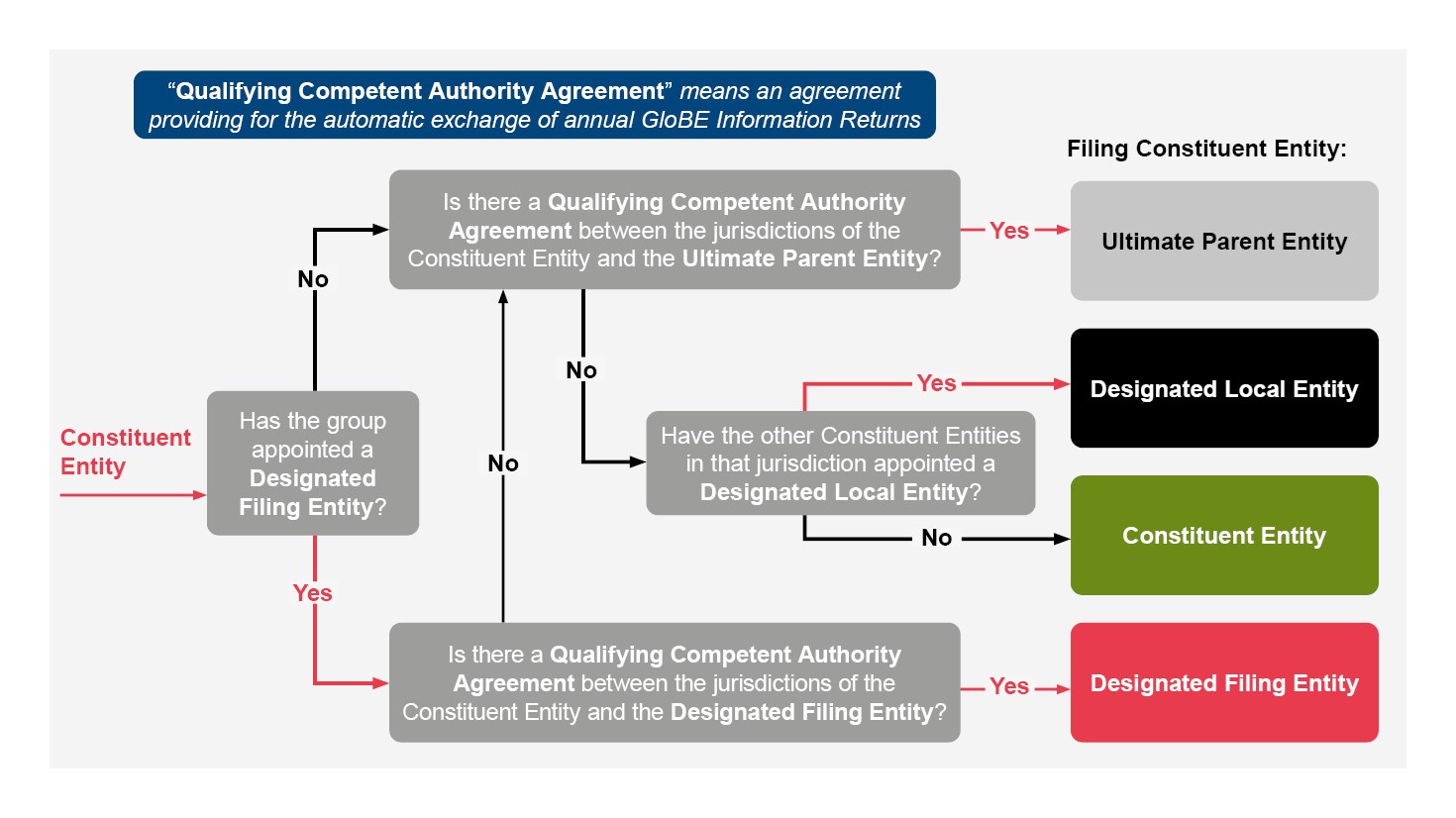

1. Executive Summary | Tax Challenges Arising from Digitalisation – Report on Pillar Two Blueprint : Inclusive Framework on BEPS | OECD iLibrary

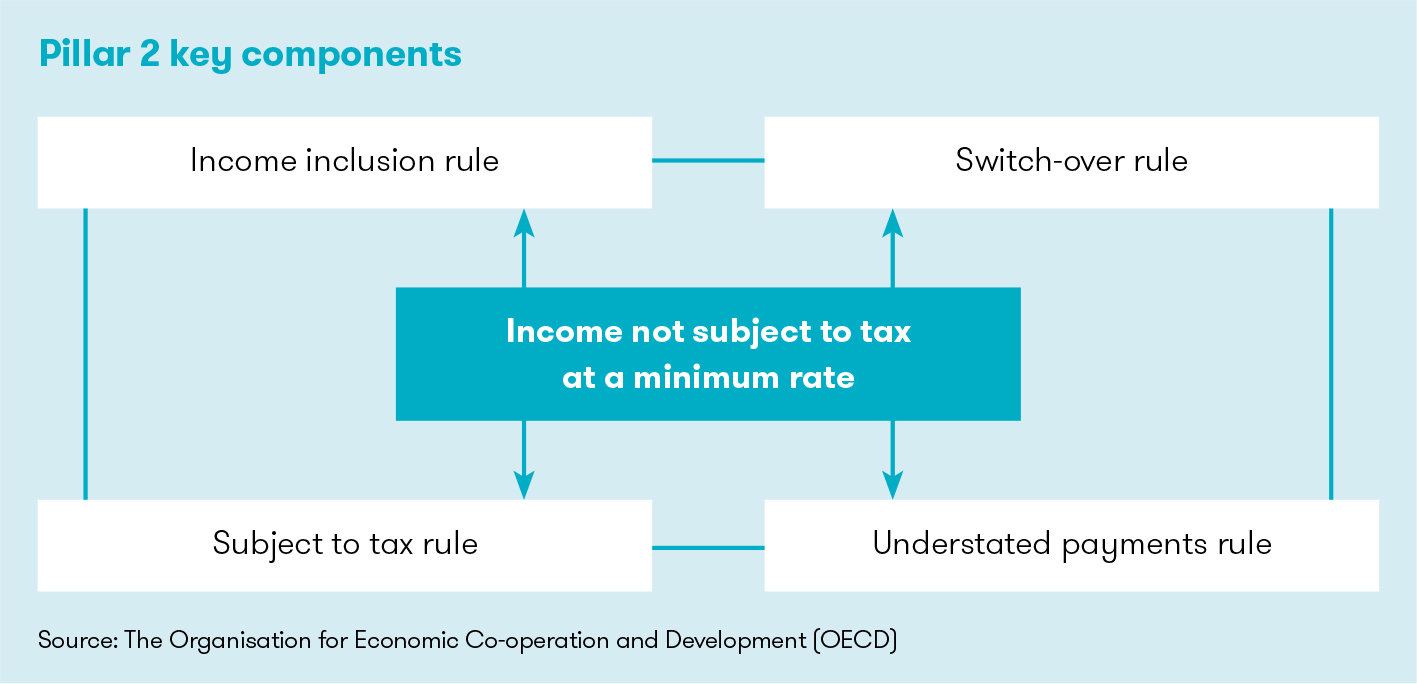

OECD Tax on X: "🆕 Model GloBE Rules under Pillar Two: what are they all about? We've got you covered! 🔍 Summary ➡️ https://t.co/YQkreyDuv7 📃 Fact sheets ➡️ https://t.co/vuhER2yeuB ❓ FAQs ➡️