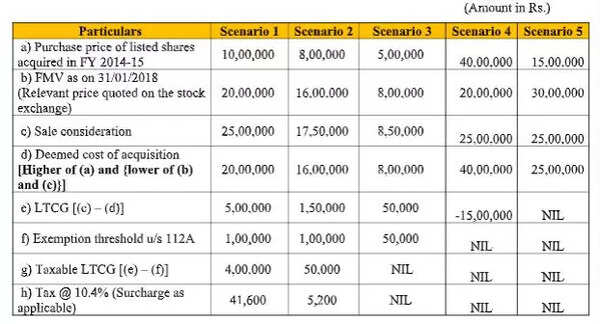

Initial public offerings, bonus and rights issues will be eligible for concessional rate of 10% long-term capital gains (LTCG) tax even if the Securities Transaction Tax (STT) has not been paid earlier.

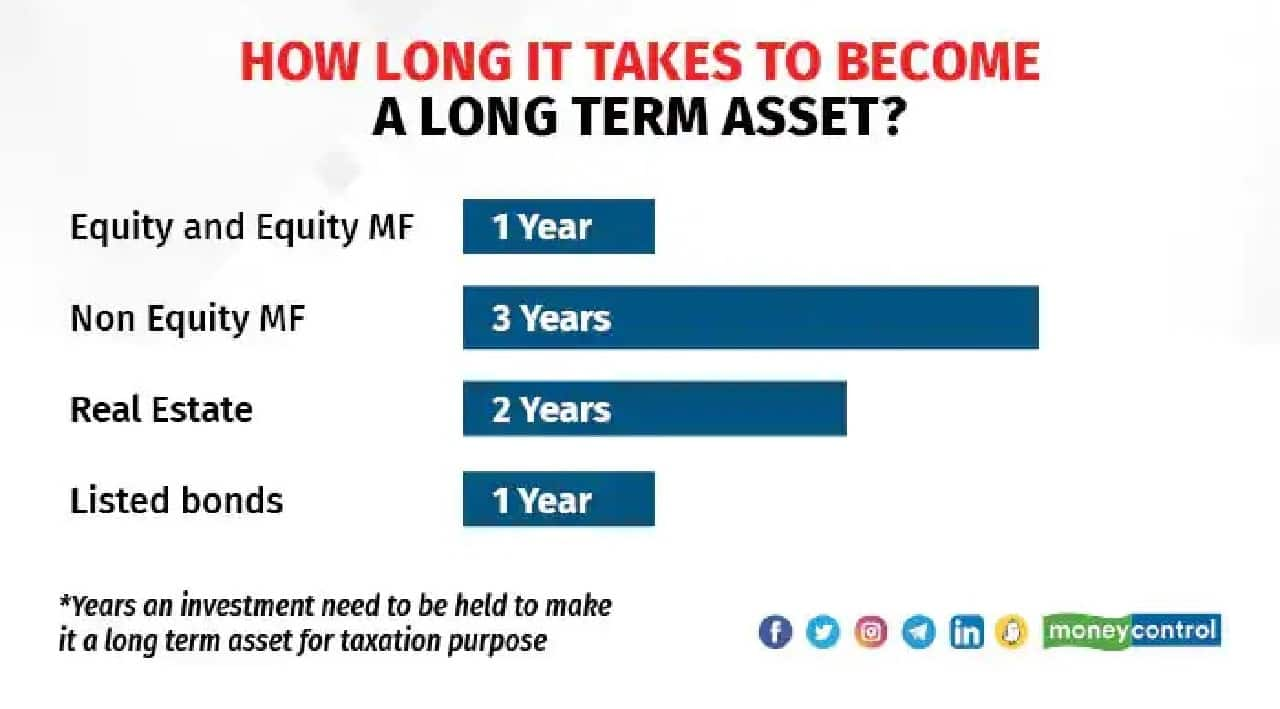

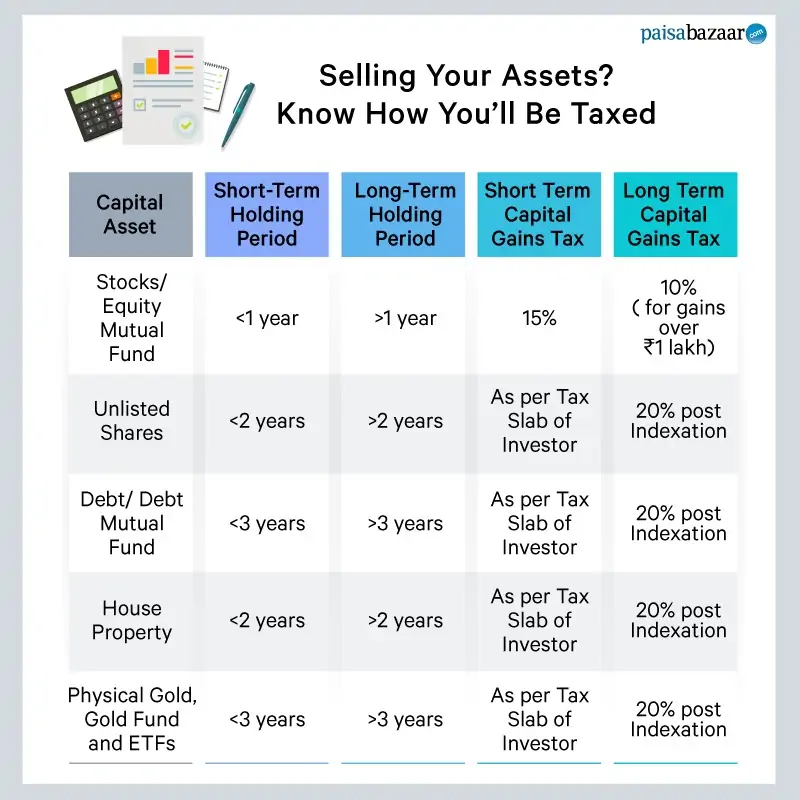

Rationalisation of holding period requirement Most investors find it hard to get a clear idea of threshold limits for deciding if an asset is classified as long-term or short-term to decide the

.jpeg)